As of February 27, 2026:

In the SIPA Liquidation of BLMIS, unresolved matters remain that require court determination. Until resolved, these matters require reserves. In addition, 3 claims have been “deemed determined pending litigation” and the SIPA Trustee must establish sufficient reserves to ensure that he would be able to make all pro rata distributions to date to all potentially eligible claimants, whether or not their claims are allowed at the time of distribution.

Required reserve for deemed determined claims: Approximately $566.2 million

General reserve: $0

Other reserves, including reserve for deferred payments and unallocated funds: Approximately $389.5 thousand

As of February 27, 2026:

Seventeenth interim distribution of 1.302%: $253.6M

Sixteenth interim distribution of 0.410%: $80M

Fifteenth interim distribution of 0.419%: $81.7M

Fourteenth pro rata interim distribution of 0.265%: $51.7M

Thirteenth pro rata interim distribution of 0.604%: $118M

Twelfth pro rata interim distribution of 1.240%: $242.6M

Eleventh pro rata interim distribution of 1.975%: $387M

Tenth pro rata interim distribution of 2.729%: $536.6M

Ninth pro rata interim distribution of 3.806%: $750.6M

Eighth pro rata interim distribution of 1.729%: $341.9M

Seventh pro rata interim distribution of 1.305%: $258.4M

Sixth pro rata interim distribution of 8.262%: $1.641B

Fifth pro rata interim distribution of 2.743%: $546.8M

Fourth pro rata interim distribution of 3.180%: $634.5M

Third pro rata interim distribution of 4.721%: $943.1M

Second pro rata interim distribution of 33.556%: $6.733B

First pro rata interim distribution of 4.602%: $926M

Amount of SIPC advances reimbursed to SIPC on fully satisfied accounts: $272.4M

In the Bernard L. Madoff Investment Securities LLC (BLMIS) liquidation, the Securities Investor Protection Corporation (SIPC) has made cash advances – up to a maximum of $500,000 per allowed claim – available to the court-appointed Securities Investor Protection Act (SIPA) Trustee to distribute to eligible customers, as a way to expedite financial relief to these customers. As of February 27, 2026, SIPC has committed approximately $850.9 million to the BLMIS liquidation for this purpose. SIPC-committed advances will continue to increase as claims that are currently in litigation are allowed as a result of settlements or the conclusion of litigation.

According to the provisions of SIPA, SIPC is reimbursed for its advances to customers once each respective customer claim is fully satisfied. SIPC has received $272.4 million in reimbursement from the Customer Fund for advances paid on fully satisfied accounts, leaving $578.5 million in SIPC advances outstanding.

*In this instance, the term "subrogation" refers to the reimbursement to SIPC of cash advances made to BLMIS customers, once the respective allowed customer claim has been fully satisfied.

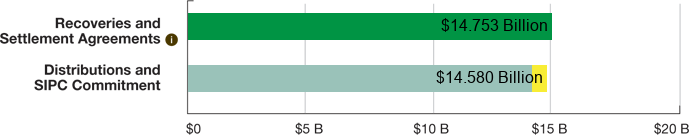

As of February 27, 2026, the Securities Investor Protection Act (SIPA) Trustee has recovered or reached agreements to recover approximately $15.366 billion. This recovery far exceeds any prior restitution effort related to Ponzi schemes both in terms of dollars and percentage of stolen funds recovered.

Significant Recoveries to Date

Kingate Global Fund, Ltd. and Kingate Euro Fund, Ltd.

On August 6, 2019, the United States Bankruptcy Court for the Southern District of New York approved an $860 million recovery agreement with Kingate Global Fund, Ltd. and Kingate Euro Fund, Ltd., BLMIS feeder funds incorporated in the British Virgin Islands.

Ascot Partners, Ascot Fund, J. Ezra Merkin, and Gabriel Capital Corporation

On July 3, 2018, the United States Bankruptcy Court for the Southern District of New York approved a recovery agreement with Ascot Partners, Ascot Fund, J. Ezra Merkin, and Gabriel Capital Corporation that benefits the BLMIS Customer Fund by $281 million.

American Securities Management, L.P., et al.

On March 26, 2018, the United States Bankruptcy Court for the Southern District of New York approved a recovery agreement with American Securities Management, L.P., f/k/a/ American Securities, L.P.; PJ Associates Group, L.P., d/b/a PJ Administrator, L.L.C.; and PJ Administrator, L.L.C., f/k/a PJ Associates Group, L.P, amongst others. The settlement benefits the BLMIS Customer Fund by approximately $18.5 million.

Alpha Prime Fund

On March 27, 2018, the United States Bankruptcy Court for the Southern District of New York approved a recovery agreement with Alpha Prime Fund Ltd., a BLMIS feeder fund incorporated under Bermuda law. Through this settlement, the SIPA Trustee will recover $76.45 million, representing 100 percent of the transfers Alpha Prime received from BLMIS in the two years preceding the commencement of BLMIS’s SIPA proceeding.

Thema International Fund PLC

On October 19, 2017, the United States Bankruptcy Court for the Southern District of New York signed an order approving a recovery agreement with Ireland-based Thema International Fund plc (“Thema International”). Under the terms of the agreement, Thema International will pay approximately $687 million to the BLMIS Customer Fund for ultimate distribution to BLMIS customers with allowed claims.

Lagoon Investment Limited and Hermes International Fund Limited

On July 24, 2017, the United States Bankruptcy Court for the Southern District of New York approved a recovery agreement with Lagoon Investment Limited (“Lagoon”), Hermes International Fund Limited (“Hermes”), and Lagoon Investment Trust (“Lagoon Trust”; together, the “Lagoon Defendants”). Lagoon is a BVI corporation that was the BLMIS account holder through which Hermes and Lagoon Trust invested with BLMIS. Under the terms of the agreements with the Lagoon and Thema Defendants, Lagoon will pay approximately $240 million to the BLMIS Customer Fund for ultimate distribution to BLMIS customers with allowed claims.

Thema Wise Investments Limited and Thema Fund Limited

On July 24, 2017, the United States Bankruptcy Court for the Southern District of New York approved a recovery agreement with Thema Fund Limited (“Thema Fund”) and Thema Wise Investments Ltd. (“Thema Wise”; together, the “Thema Defendants”). The Thema funds are based in BVI. Under the terms of the agreement, Thema Wise will pay approximately $130 million to the BLMIS Customer Fund for ultimate distribution to BLMIS customers with allowed claims.

Madoff Family Estates, et al.

On July 24, 2017, the United States Bankruptcy Court for the Southern District of New York approved a settlement between the SIPA Trustee and the United States Attorney’s Office for the Southern District of New York (the “Government”), and the Estate of Mark D. Madoff, the Estate of Andrew H. Madoff (collectively, the “Madoff Brothers’ Estates”), and Mark Madoff’s widow, Stephanie Mack (a/k/a Stephanie Madoff; “Mack”). Under the terms of the agreement, the SIPA Trustee and the Government will receive more than $23 million in cash and other assets from the Madoff Brothers’ Estates and Mack. The total recovery will be shared equally between the SIPA Trustee and the Government. All proceeds of the settlement received by the SIPA Trustee will benefit the Customer Fund for ultimate distribution to BLMIS customers with allowed claims.

Cohmad Securities Corporation, Estate of Maurice “Sonny” Cohn, Marcia B. Cohn and Marilyn Cohn

On November 29, 2016, the United States Bankruptcy Court for the Southern District of New York approved a recovery agreement between the SIPA Trustee and Cohmad Securities Corporation, et al. Under the terms of the agreement, the settlement benefitted the BLMIS Customer Fund by approximately $32 million. This amount represents more than 100 percent of the amount transferred by BLMIS to Sonny Cohn, Marilyn Cohn and Marcia Cohn as withdrawals from their Investment Advisory Accounts during the six-year period prior to the BLMIS liquidation filing, and more than 100 percent of the fees for referrals made to BLMIS that Sonny Cohn and Marcia Cohn received during the six-year period prior to the BLMIS liquidation filing.

Estate of Stanley Chais, et al.

On November 19, 2016, the United States Bankruptcy Court for the Southern District of New York approved a global settlement – made in cooperation with the California Attorney General -with the defendants in Picard v. the Estate of Stanley Chais, et al. The agreement was made with the Stanley Chais estate, Chais’s widow, and a number of Chais family members, investment funds, trusts, companies, and other entities associated with Chais. Under the terms of the agreement, the BLMIS Customer Fund has received payments totaling $261.45 million through August 24, 2020, in addition to the assignment of other assets that will be liquidated over time. All proceeds of the settlement will go to the BLMIS Customer Fund for the benefit of BLMIS customers with allowed claims.

Dorado Invesment Company, et al.

On April 26, 2016, the United States Bankruptcy Court for the Southern District of New York approved a recovery agreement between the SIPA Trustee and Dorado Investment Company, et al. that benefits the BLMIS Customer Fund by approximately $30 million.

Vizcaya Partners Ltd., Asphalia Fund Ltd., and Zeus Partners Ltd.

On January 26, 2016, the United States Bankruptcy Court for the Southern District of New York approved a recovery agreement with Vizcaya Partners Limited, Asphalia Fund Limited, and Zeus Partners Limited. The settlement will benefit the BLMIS Customer Fund by approximately $25 million.

Thybo

On November 17, 2015, the United States Bankruptcy Court for the Southern District of New York approved a recovery agreement with Thybo Asset Management Limited and Thybo Stable Fund Ltd. The settlement will benefit the BLMIS Customer Fund by approximately $46.6 million. The payment amount reflects 75 percent of the $62 million withdrawn by the defendants within the six-year period prior to the BLMIS liquidation filing date, and also reflects an adjustment based on the recovery received by the SIPA Trustee as a result of his settlement with the Internal Revenue Service.

Plaza Investments International Limited and Notz, Stucki Management (Bermuda) Limited

On July 28, 2015, the United States Bankruptcy Court for the Southern District of New York approved a recovery agreement between the SIPA Trustee and Plaza Investments International Limited and Notz, Stucki Management (Bermuda) Limited. Under the agreement, Plaza et al. agreed to make a payment of $140 million to immediately benefit the BLMIS Customer Fund. This payment represents approximately 60 percent of the amount transferred from BLMIS to Plaza during the six-year period prior to the BLMIS liquidation filing and also includes 100 percent of the preference and transfers from BLMIS to the Plaza defendants that occurred within two years of the BLMIS liquidation filing.

Ariel Fund Limited and Gabriel Capital, L.P.

On June 23, 2015, the United States Bankruptcy Court for the Southern District of New York approved a recovery agreement between the SIPA Trustee and Bart M. Schwartz, the court-appointed Receiver for Ariel Fund Limited and Gabriel Capital, L.P. The agreement with Ariel Fund immediately benefitted the BLMIS Customer Fund by approximately $18 million, and the settlement with Gabriel Capital, L.P. benefited the BLMIS Customer Fund by approximately $17.4 million. These payments by Ariel Fund Limited and Gabriel Capital, L.P. represent 100 percent of the amount transferred from BLMIS to the funds.

Defender

On April 16, 2015, the United States Bankruptcy Court for the Southern District of New York approved a recovery agreement between the SIPA Trustee and Defender Limited and related entities. Defender was a Madoff feeder fund that deposited its assets with BLMIS. Under the terms of the agreement, the BLMIS Customer Fund will benefit by $93 million, representing 100 percent of the fraudulent transfers and preference payments which the SIPA Trustee sought to recover from Defender. The settlement agreement was also structured to further the SIPA Trustee’s avoidance and recovery efforts through additional discovery in other adversary proceedings in which the SIPA Trustee is seeking to recover more than a half-billion dollars of customer property.

Herald Fund SPC and Primeo Fund

On December 17, 2014, the United States Bankruptcy Court for the Southern District of New York approved the SIPA Trustee’s settlement with Herald Fund SPC and Primeo Fund. On November 17, 2014, the SIPA Trustee filed a motion in the United States Bankruptcy Court for the Southern District of New York seeking approval of a recovery agreement with Herald Fund SPC and Primeo Fund, two feeder funds primarily invested in BLMIS. Under the terms of the agreement, the settlement will benefit the BLMIS Customer Fund by approximately $497 million.

Senator Fund SPC

On December 17, 2014, the United States Bankruptcy Court for the Southern District of New York approved the SIPA Trustee’s settlement with Senator Fund SPC. On November 18, 2014, the SIPA Trustee filed a motion in the United States Bankruptcy Court for the Southern District of New York seeking approval of a recovery agreement with Senator Fund SPC, a Cayman Islands incorporated investment fund invested exclusively with BLMIS. Under the terms of the agreement, the settlement will benefit the BLMIS Customer Fund by $95 million. The agreement with Senator represents 100 percent of the principal withdrawals by Senator from BLMIS.

Edward Blumenfeld, et al.

On November 19, 2014, the United States Bankruptcy Court for the Southern District of New York approved a settlement between the SIPA Trustee and the defendants in Picard v. Edward Blumenfeld, et al. The settlement motion was filed with the United States Bankruptcy Court for the Southern District of New York on October 17, 2014. The agreement has an aggregate potential value of approximately $62 million for the BLMIS Customer Fund. Under the agreement, the Blumenfeld defendants agreed to make an immediate payment of $32.75 million to the BLMIS Customer Fund for the benefit of BLMIS customers with allowed claims. The Blumenfeld defendants also agreed to transfer their customer claims in the Madoff SIPA liquidation, totaling approximately $29.35 million, to the SIPA Trustee. Since the customer claims were immediately entitled to the four interim pro rata distributions that had been made to date, plus up to the $500,000 SIPC advance each, the BLMIS Customer Fund immediately benefitted by an additional $17.7 million, making the total payment at the time of the settlement agreement approximately $50.47 million. An additional $7.09 million has been paid to the BLMIS Customer Fund as a result of the fifth through seventeenth pro rata distributions, which commenced on February 6, 2015 through February 27, 2026, bringing the total recoveries under the Blumenfeld settlement to approximately $57.56 million. The SIPA Trustee could capture up to an additional $4.53 million from future pro rata distributions on the transferred claims for the benefit of BLMIS customers with allowed claims.

JPMorgan Chase

On February 4, 2014, the United States Bankruptcy Court for the Southern District of New York approved two agreements totaling approximately $543 million for the benefit of BLMIS customers. The agreements settled avoidance claims asserted by the SIPA Trustee against JPMorgan for $325 million, as well as common law claims brought separately by the SIPA Trustee and in a class action lawsuit, which mirrored the claims developed by the SIPA Trustee’s legal team, for $218 million. Of the $325 million that JPMC will pay to the SIPA Trustee, $50 million will be given to the joint liquidators of the Fairfield Sentry Funds for distribution to the indirect investors in the Fairfield Sentry Funds, as part of the cooperative agreement reached in May 2011 to share a percentage of certain future recoveries. On March 25, 2014, the SIPA Trustee filed a motion for an order approving a fourth allocation of property to the Customer Fund and requesting approval to authorize a fourth interim distribution to BLMIS customers with allowed claims. In that filing, the SIPA Trustee sought approval from the United States Bankruptcy Court to allocate a net amount of $275 million from the JPMC settlement to the BLMIS Customer Fund. Bankruptcy Court approval for the fourth pro rata interim distribution was granted on April 18, 2014, following the April 17, 2014 hearing in the United States Bankruptcy Court, and the distribution commenced on May 5, 2014.

Maxam Absolute Return Fund L.P.

On September 17, 2013, United States Bankruptcy Court for the Southern District of New York approved the $97.8 million settlement with the Maxam Absolute Return Fund L.P. and other related funds and entities, including Sandra L. Manzke and members of her family (collectively, the Maxam Defendants). The settlement represents the recovery of 100 percent of the Maxam Defendants’ withdrawals from BLMIS. In addition, the settlement benefits the indirect investors in Maxam. A claim totaling more than $276 million will be allowed, comprised of Maxam’s net equity claim of approximately $215 million plus approximately $61 million representing only half of the non-preference claim – a significant discount negotiated by the SIPA Trustee. In addition, the Manzke family trust will waive 50 percent of its right to any future distributions of funds received by Maxam as a result of its allowed customer claim.

Union Bancaire Privée

On January 6, 2011, the United States Bankruptcy Court for the Southern District of New York approved a pre-litigation settlement between the SIPA Trustee and Union Bancaire Privée that resulted in the recovery of $470 million. Under the settlement, under certain conditions the SIPA Trustee was entitled to an additional $49 million from UBP or other entities. On August 8, 2013, UBP paid $30 million dollars and the non-UBP related entities paid $19 million.

Beacon & Andover

On December 4, 2012, the United States District Court for the Southern District of New York approved a settlement agreement between the SIPA Trustee and individuals, feeder funds and entities related to, among others, the Beacon Associates Management Corporation, Andover Associates Management Corporation and Ivy Asset Management. Under the terms of the settlement, the defendants made a $24 million payment to the BLMIS Customer Fund, which represents a return of 100 percent of the defendants’ withdrawals from BLMIS during the six-year period prior to the commencement of the liquidation of BLMIS, plus additional recoveries for direct withdrawals and subsequent transfers made to various defendants. In addition, the defendants, who acted as feeder fund managers, advisors and/or consultants in one or more BLMIS feeder funds, will forego all fees otherwise due to them that would be paid out of distributions by the BLMIS estate.

Fairfield Funds

On June 7, 2011, the United States Bankruptcy Court for the Southern District of New York approved a settlement agreement between the SIPA Trustee and the Joint Liquidators of Fairfield Sentry Limited the Joint Liquidators of Fairfield Sentry Limited, Fairfield Sigma Limited and Fairfield Lambda Limited (collectively, the Fairfield Funds). Terms of the settlement include an immediate and permanent reduction – of $730 million – in the total amount of claims against the BLMIS Customer Fund by the Fairfield Funds, which would effectively increase future payments to customers with allowed claims. In addition, the settlement agreement aligned the interests of the SIPA Trustee and his counsel with the Joint Liquidators of Fairfield Sentry, strengthening both parties’ abilities to pursue and recover additional claims against the owners and management of the Fairfield Funds, as well as hundreds of subsequent transferees of customer property. The Joint Liquidators also agreed to make a $70 million payment to the SIPA Trustee with an initial payment of $24 million which has been paid by an $8 million offset of funds owed to the Fairfield Joint Liquidators and a $16 million cash payment by the Liquidators to the BLMIS Customer Fund. The remaining $46 million was paid to the SIPA Trustee on November 28, 2012.

Saul Katz, et al.

On June 1, 2012, the United States District Court for the Southern District of New York approved a $162 million settlement agreement between the SIPA Trustee and Saul B. Katz, et al (“KW Settling Parties”). The 2012 agreement between the two parties allows the BLMIS Customer Fund to recoup six years of fictitious profits. Under terms of the settlement, the KW Settling Parties’ allowed claims of approximately $177 million (BLMIS accounts in which the KW Settling Parties had deposited more money than they had withdrawn – their “net loser” accounts) were unconditionally assigned to the SIPA Trustee until the $162 million settlement amount is reached. Distributions made on the allowed claims assigned to the SIPA Trustee were added to the BLMIS Customer Fund to reduce the amount owed by the KW Settling Parties. On September 28, 2012 through December 4, 2015, a total of $100.767 million was paid to the BLMIS Customer Fund as a result of the first through sixth pro rata distributions.

In the spring of 2016, the KW Settling Parties requested a modification to the June 1, 2012 Settlement Agreement, asking that payments owed to the SIPA Trustee in 2016 and 2017 be extended over a longer period of time in exchange for interest payments, while efforts continue on the part of the SIPA Trustee and his legal team to recover monies that can and will be used to offset those payments through future pro rata interim distributions. The SIPA Trustee agreed to those modifications. (For the full May 31, 2016 statement on the revised agreement, please click here.) As of June 1, 2016, the settlement amount of $162 million had been reduced to approximately $45.233 million, through the first six distributions the SIPA Trustee made on the account of the Katz Wilpon assigned customer claims, as well as a $16 million payment made by the KW Settling Parties on June 1, 2016. The seventh interim distribution, which commenced June 30, 2016, resulted in an additional reduction of $2.304 million from the balance. The eighth interim pro rata distribution, which commenced on February 2, 2017, resulted in an additional reduction of $3.053 million from the balance. An installment payment was received on June 1, 2017 in the amount of $9.980 million. The ninth interim distribution, which commenced on February 22, 2018, resulted in recoveries of $6.721 million. An installment payment was received on June 1, 2018 in the amount of $4.279 million. The tenth interim distribution, which commenced on February 22, 2019 resulted in recoveries of $4.819 million. An installment payment was received on June 1, 2019 in the amount of $5.848 million. The eleventh interim distribution, which commenced on February 28, 2020, resulted in recoveries of $3.488 million. The twelfth interim distribution, which commenced on February 26, 2021, resulted in recoveries of $2.190 million. A final installment payment was received on June 1, 2021 in the amount of $4.863 million, satisfying the settlement amount in full.

Trotanoy Investment Company, Ltd.

On May 15, 2012, the United States Bankruptcy Court for the Southern District of New York approved a settlement agreement between the SIPA Trustee and Trotanoy Investment Company, Ltd. (Trotanoy), a Bailiwick of Guernsey limited liability company. The settlement with Trotanoy resulted in a $28.96 million cash settlement payment to the Customer Fund, representing a return of 100 percent of Trotanoy’s withdrawals during the 90-day preference period.

IRS

On December 21, 2011, a $326 million settlement with the United States of America, on behalf of the Internal Revenue Service, was approved by the United States Bankruptcy Court for the Southern District of New York. The SIPA Trustee determined that BLMIS falsely debited the accounts of 126 foreign account holders for alleged U.S. federal income tax withholding and paid to the IRS amounts withheld related to alleged dividends. Because no securities were purchased and thus no dividends were actually ever received by BLMIS, no amounts should have been withheld and transferred to the IRS. After receipt of the settlement payment, the specific accounts were credited for the amounts transferred from 2002 – 2008 and, where appropriate, a catch-up pro rata interim distribution of 4.602 percent for the credited amount has been made. On March 25, 2014, the SIPA Trustee filed a motion for an order approving a fourth allocation of property to the Customer Fund and requesting approval to authorize a fourth interim distribution to BLMIS customers with allowed claims. In that filing, the SIPA Trustee indicated that he has removed the $103 million in reserve that was set aside since December 21, 2011, when the IRS settlement became final. The IRS settlement authorized the SIPA Trustee to release the reserve two years and sixty days after the order approving the settlement agreement became final. The fourth pro rata interim distribution was approved by the Court and commenced on May 5, 2014.

Mount Capital Fund

On October 4, 2011, the United States Bankruptcy Court for the Southern District of New York approved a settlement with Mount Capital Fund, a BLMIS feeder fund in liquidation in the British Virgin Islands, which returned $43.5 million to the BLMIS Customer Fund.

Tremont Group

On July 28, 2011, the SIPA Trustee announced a settlement with Tremont Group Holdings Inc. and related entities under the terms of which the defendants will deliver cash payments into escrow totaling $1.025 billion, which will ultimately be placed into the Customer Fund and distributed, pro rata, to BLMIS customers with allowed claims. On September 22, 2011, the agreement was approved by the United States Bankruptcy Court for the Southern District of New York, but was appealed by third-party appellants. On June 27, 2012, the Honorable Judge Daniels of the United States District Court for the Southern District of New York granted the SIPA Trustee’s motion to dismiss the appeal. On July 26, 2012, a notice of appeal of the District Court decision was filed by the third-party appellants. The appeal was dismissed by the United States Court of Appeals for the Second Circuit on October 25, 2012. Under the settlement agreement, the $1.025 billion recovered for the BLMIS Customer Fund was placed in escrow for 90 days from the closing date of November 6, 2012. On February 8, 2013, the $1.025 billion was released to the SIPA Trustee for the BLMIS Customer Fund.

Greenwich Funds

On May 18, 2011, a settlement agreement was announced with Greenwich Sentry L.P. and Greenwich Sentry Partners, L.P. (combined, the Greenwich Funds), domestic BLMIS feeder funds operated by the Fairfield Greenwich Group (FGG) that were 100 percent invested in BLMIS. Terms of the settlement, which was structured very similarly to the settlement with the Fairfield Funds, included a reduction in the Greenwich Fund customer claims that will ultimately benefit BLMIS customers with approved claims. Under the agreement, the Greenwich Funds also agreed to assign all of their claims against FGG management companies, officers and partners to the Trustee and to the entry of judgment for the full amount of the Trustee’s claims, approximately $212 million. The settlement was approved on June 21, 2011 by the United States Bankruptcy Court for the Southern District of New York. On February 24, 2012, both the Greenwich Sentry and Greenwich Sentry Partners Chapter 11 Reorganization Plans and the settlement agreement became effective.

Hadassah

On March 10, 2011, the United States Bankruptcy Court for the Southern District of New York approved a settlement between the SIPA Trustee and Hadassah in the amount of $45 million. On or about March 28, 2011, Hadassah transferred $45 million to the SIPA Trustee.

Carl J. Shapiro, et al.

On December 21, 2010, the United States Bankruptcy Court for the Southern District of New York approved a pre-litigation settlement between the SIPA Trustee and Carl J. Shapiro, Robert Jaffe and related entities in the amount of $550 million. As part of the agreement, the Shapiros also forfeited $75 million to the U.S. government.

Estate of Jeffry Picower

On January 13, 2011, the United States Bankruptcy Court for the Southern District of New York approved the SIPA Trustee’s $5 billion settlement with the estate of Jeffry Picower. This decision was appealed to the United States District Court for the Southern District of New York, which affirmed the decision of the Bankruptcy Court on March 26, 2012. Notices of appeal on the District Court’s order to the United States Court of Appeals for the Second Circuit were filed on April 24, 2012.

On July 16, 2012, the deadline for further appeals of the approximately $7.2 billion Picower forfeiture to the United States Government expired, making the forfeiture order final. Under the settlement agreement, the $5 billion settlement payment was released to the SIPA Trustee.

Norman F. Levy, et al.

On February 18, 2010, the United States Bankruptcy Court for the Southern District of New York approved a pre-litigation settlement between the SIPA Trustee and the estate of Norman F. Levy. This settlement resulted in the return of $220 million (the Norman Levy Settlement). Certain customers moved to set aside the Court’s order approving the Norman Levy settlement. The Bankruptcy Court denied the motion, and the claimants filed an appeal in United States District Court on April 11, 2011. On February 16, 2012, the District Court upheld the Bankruptcy Court’s earlier ruling approving the SIPA Trustee's settlement with the Levy family. The District Court’s ruling was appealed to the United States Court of Appeals for the Second Circuit, which affirmed the judgment of the District Court. On March 21, 2013, the period to challenge the Circuit Court’s ruling expired and the settlement became final, and unappealable. The $220 million was included in the Customer Fund and the SIPA Trustee had requested its inclusion in the fourth interim distribution to BLMIS customers with allowed claims. The fourth pro rata interim distribution was approved by the Court and commenced on May 5, 2014.

Optimal

On June 16, 2009, the United States Bankruptcy Court for the Southern District of New York approved a pre-litigation settlement between the SIPA Trustee and Optimal Strategic U.S. Equity Ltd. and Optimal Arbitrage Ltd. This settlement resulted in the recovery of more than $235 million.