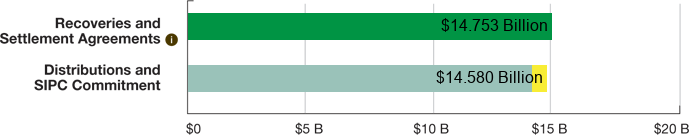

As of June 20, 2025, the Securities Investor Protection Act (SIPA) Trustee has recovered or reached agreements to recover approximately $14.765 billion. This recovery far exceeds any prior restitution efforts related to Ponzi schemes both in terms of dollars and percentage of stolen funds recovered.

One hundred percent of the SIPA Trustee's recoveries will be allocated to the Customer Fund for distribution to BLMIS customers with allowed claims. The costs associated with the SIPA Trustee’s recovery and settlement efforts are paid by the Securities Investor Protection Corporation (SIPC), which administers a fund drawn upon assessments on the securities industry. No fees or other costs of administration are paid from recoveries obtained by the SIPA Trustee for the benefit of BLMIS customers with allowed claims.

Distributions and SIPC Commitment Breakdown

As of June 20, 2025:

Sixteenth Pro Rata Interim Distribution (0.410%)

The sixteenth pro rata interim distribution from the Bernard L. Madoff Investment Securities LLC (BLMIS) Customer Fund to eligible customers commenced on February 28, 2025. Approximately $76.8 million has been distributed to BLMIS account holders with allowed claims in the sixteenth distribution, representing 0.410 percent of the allowed claim amount of each account, unless the claim is fully satisfied.

Fifteenth Pro Rata Interim Distribution (0.419%)

The fifteenth pro rata interim distribution from the Bernard L. Madoff Investment Securities LLC (BLMIS) Customer Fund to eligible customers commenced on February 23, 2024. Approximately $78.6 million has been distributed to BLMIS account holders with allowed claims in the fifteenth distribution, representing 0.419 percent of the allowed claim amount of each account, unless the claim is fully satisfied.

Fourteenth Pro Rata Interim Distribution (0.265%)

The fourteenth pro rata interim distribution from the Bernard L. Madoff Investment Securities LLC (BLMIS) Customer Fund to eligible customers commenced on February 24, 2023. Approximately $49.7 million has been distributed to BLMIS account holders with allowed claims in the fourteenth distribution, representing 0.265 percent of the allowed claim amount of each account, unless the claim is fully satisfied.

Thirteenth Pro Rata Interim Distribution (0.604%)

The thirteenth pro rata interim distribution from the Bernard L. Madoff Investment Securities LLC (BLMIS) Customer Fund to eligible customers commenced on February 25, 2022. Approximately $113.4 million has been distributed to BLMIS account holders with allowed claims in the thirteenth distribution, representing 0.604 percent of the allowed claim amount of each account, unless the claim is fully satisfied.

Twelfth Pro Rata Interim Distribution (1.240%)

The twelfth pro rata interim distribution from the Bernard L. Madoff Investment Securities LLC (BLMIS) Customer Fund to eligible customers commenced on February 26, 2021. Approximately $233.1 million has been distributed to BLMIS account holders with allowed claims in the twelfth distribution, representing 1.240 percent of the allowed claim amount of each account, unless the claim is fully satisfied.

Eleventh Pro Rata Interim Distribution (1.975%)

The eleventh pro rata interim distribution from the Bernard L. Madoff Investment Securities LLC (BLMIS) Customer Fund to eligible customers commenced on February 28, 2020. Approximately $372 million has been distributed to BLMIS account holders with allowed claims in the eleventh distribution, representing 1.975 percent of the allowed claim amount of each account, unless the claim is fully satisfied.

Tenth Pro Rata Interim Distribution (2.729%)

The tenth pro rata interim distribution from the Bernard L. Madoff Investment Securities LLC (BLMIS) Customer Fund to eligible customers commenced on February 22, 2019. Approximately $515.9 million has been distributed to BLMIS account holders with allowed claims in the tenth distribution, representing 2.729 percent of the allowed claim amount of each account, unless the claim is fully satisfied.

Ninth Pro Rata Interim Distribution (3.806%)

The ninth pro rata interim distribution from the Bernard L. Madoff Investment Securities LLC (BLMIS) Customer Fund to eligible customers commenced on February 22, 2018. Approximately $721.7 million has been distributed to BLMIS account holders with allowed claims in the ninth distribution, representing 3.806 percent of the allowed claim amount of each account, unless the claim is fully satisfied.

Eighth Pro Rata Interim Distribution (1.729%)

The eighth pro rata interim distribution from the Bernard L. Madoff Investment Securities LLC (BLMIS) Customer Fund to eligible customers commenced on February 2, 2017. Approximately $328.8 million has been distributed to BLMIS account holders with allowed claims in the eighth distribution, representing 1.729 percent of the allowed claim amount of each account, unless the claim is fully satisfied.

Seventh Pro Rata Interim Distribution (1.305%)

The seventh pro rata interim distribution from the Bernard L. Madoff Investment Securities LLC (BLMIS) Customer Fund to eligible customers commenced on June 30, 2016. Approximately $248.5 million has been distributed to BLMIS account holders with allowed claims in the seventh distribution, representing approximately 1.305 percent of the allowed claim amount of each account, unless the claim is fully satisfied.

Sixth Pro Rata Distribution (8.262%)

The sixth pro rata interim distribution from the Bernard L. Madoff Investment Securities LLC (BLMIS) Customer Fund to eligible customers commenced on December 4, 2015. Approximately $1.578 billion has been distributed to BLMIS account holders with allowed claims in the sixth distribution, representing approximately 8.262 percent of the allowed claim amount of each account, unless the claim is fully satisfied.

Fifth Pro Rata Interim Distribution (2.743%)

The fifth pro rata interim distribution from the Bernard L. Madoff Investment Securities LLC (BLMIS) Customer Fund to eligible customers commenced on February 6, 2015. Approximately $526 million has been distributed to BLMIS account holders with allowed claims in the fifth distribution, representing approximately 2.743 percent of the allowed claim amount of each individual account, unless the claim is fully satisfied.

Fourth Pro Rata Interim Distribution (3.180%)

The fourth pro rata interim distribution from the Bernard L. Madoff Investment Securities LLC (BLMIS) Customer Fund to eligible customers commenced on May 5, 2014. Approximately $610.4 million has been distributed to BLMIS account holders with allowed claims in the fourth distribution, representing approximately 3.180 percent of the allowed claim amount of each individual account, unless the claim is fully satisfied.

Third Pro Rata Interim Distribution (4.721%)

The third pro rata interim distribution from the Bernard L. Madoff Investment Securities LLC (BLMIS) Customer Fund to eligible customers commenced March 29, 2013. Approximately $907.3 million has been distributed to BLMIS account holders with allowed claims in the third distribution, representing approximately 4.721 percent of the allowed claim amount of each individual account, unless the claim is fully satisfied.

Second Pro Rata Interim Distribution (33.556%)

The second pro rata interim distribution from the Bernard L. Madoff Investment Securities LLC (BLMIS) Customer Fund to eligible BLMIS customers commenced September 19, 2012. Approximately $6.478 billion has been distributed to BLMIS account holders with allowed claims through the second pro rata interim distribution, representing approximately 33.556 percent of the allowed claim amount of each individual account, unless the claim is fully satisfied.

First Pro Rata Interim Distribution (4.602%)

The first pro rata interim distribution from the Bernard L. Madoff Investment Securities LLC (BLMIS) Customer Fund to eligible BLMIS customers commenced October 5, 2011. Approximately $891.1 million has been distributed to BLMIS account holders with allowed claims through the first pro rata interim distribution, representing approximately 4.602 percent of the allowed claim amount of each individual account, unless the claim is fully satisfied.

Amount of SIPC advances reimbursed to SIPC on fully satisfied accounts - $261.5 Million

SIPC is authorized to administer funds to customers of failed brokerage firms as an advance against recovered assets. In this case, SIPC to date has advanced to the court-appointed SIPA Trustee approximately $850.4 million in funds to distribute to BLMIS customers with allowed claims.

According to the provisions of SIPA, SIPC is reimbursed for its advances to customers once each respective customer claim is fully satisfied. SIPC has received $261.5 million in reimbursement from the BLMIS Customer Fund for advances paid on fully satisfied claims, leaving $588.9 million in SIPC advances outstanding.

One hundred percent of the SIPA Trustee's recoveries will be allocated to the BLMIS Customer Fund for distribution to BLMIS customers with allowed claims. The reimbursements to SIPC are for the cash advances to BLMIS customers with allowed claims, which are made when the BLMIS customer claim is first allowed.

$13.991 Billion

$13.991 BillionIn the Bernard L. Madoff Investment Securities LLC (BLMIS) liquidation, the Securities Investor Protection Corporation (SIPC) has made cash advances – up to a maximum of $500,000 per allowed claim – available to the court-appointed Securities Investor Protection Act (SIPA) Trustee to distribute to allowed claimants, as a way to expedite financial relief to these customers. As of June 20, 2025, SIPC has committed approximately $850.4 million to the BLMIS liquidation for this purpose. SIPC-committed advances will continue to increase as claims that are currently in litigation are allowed as a result of settlements or the conclusion of litigation.

According to the provisions of SIPA, SIPC is reimbursed for its advances to customers once each respective customer claim is fully satisfied. SIPC has received $261.5 million in reimbursement from the Customer Fund for advances paid on fully satisfied accounts, leaving $588.9 million in SIPC advances outstanding.

*In this instance, the term "subrogation" refers to the reimbursement to SIPC of cash advances made to BLMIS customers, once the respective allowed customer claim has been fully satisfied.

$588.9 Million

$588.9 MillionFor additional information on the Customer Fund, recoveries, distributions, and fees, please click here.