As of April 19, 2024:

In the SIPA Liquidation of BLMIS, unresolved matters remain that require court determination. Until resolved, these matters require reserves. In addition, 11 claims have been “deemed determined pending litigation” and the SIPA Trustee must establish sufficient reserves to ensure that he would be able to make all pro rata distributions to date to all potentially eligible claimants, whether or not their claims are allowed at the time of distribution.

Required reserve for deemed determined claims: Approximately $748.1 million

General reserve: $0

Other reserves, including reserve for deferred payments and unallocated funds: Approximately $12.5 million

As of April 19, 2024:

Fifteenth interim distribution of 0.419%: $78.6M

Fourteenth pro rata interim distribution of 0.265%: $49.7M

Thirteenth pro rata interim distribution of 0.604%: $113.4M

Twelfth pro rata interim distribution of 1.240%: $233.1M

Eleventh pro rata interim distribution of 1.975%: $372M

Tenth pro rata interim distribution of 2.729%: $515.9M

Ninth pro rata interim distribution of 3.806%: $721.7M

Eighth pro rata interim distribution of 1.729%: $328.8M

Seventh pro rata interim distribution of 1.305%: $248.5M

Sixth pro rata interim distribution of 8.262%: $1.578B

Fifth pro rata interim distribution of 2.743%: $526M

Fourth pro rata interim distribution of 3.180%: $610.4M

Third pro rata interim distribution of 4.721%: $907.3M

Second pro rata interim distribution of 33.556%: $6.478B

First pro rata interim distribution of 4.602%: $891.1M

Amount of SIPC advances reimbursed to SIPC on fully satisfied accounts: $258.1M

In the Bernard L. Madoff Investment Securities LLC (BLMIS) liquidation, the Securities Investor Protection Corporation (SIPC) has made cash advances – up to a maximum of $500,000 per allowed claim – available to the court-appointed Securities Investor Protection Act (SIPA) Trustee to distribute to eligible customers, as a way to expedite financial relief to these customers. As of April 19, 2024, SIPC has committed approximately $850.4 million to the BLMIS liquidation for this purpose. SIPC-committed advances will continue to increase as claims that are currently in litigation are allowed as a result of settlements or the conclusion of litigation.

According to the provisions of SIPA, SIPC is reimbursed for its advances to customers once each respective customer claim is fully satisfied. SIPC has received $258.1 million in reimbursement from the Customer Fund for advances paid on fully satisfied accounts, leaving $592.2 million in SIPC advances outstanding.

*In this instance, the term "subrogation" refers to the reimbursement to SIPC of cash advances made to BLMIS customers, once the respective allowed customer claim has been fully satisfied.

- Fifteenth Pro Rata Distribution

- Fourteenth Pro Rata Distribution

- Thirteenth Pro Rata Distribution

- Twelfth Pro Rata Interim Distribution

- Eleventh Pro Rata Interim Distribution

- Tenth Pro Rata Interim Distribution

- Ninth Pro Rata Interim Distribution

- Eighth Pro Rata Interim Distribution

- Seventh Pro Rata Interim Distribution

- Sixth Pro Rata Interim Distribution

- Fifth Pro Rata Interim Distribution

- Fourth Pro Rata Interim Distribution

- Third Pro Rata Interim Distribution

- Second Pro Rata Interim Distribution

- First Pro Rata Interim Distribution

- Interim Distribution Calculation

- Required Reserves

- Advances Reimbursed to SIPC on Fully Satisfied Accounts

- Claims Calculations - Example One

- Claims Calculations - Example Two

Fifteenth Pro Rata Interim Distribution (0.419%)

The fifteenth pro rata interim distribution from the Bernard L. Madoff Investment Securities LLC (BLMIS) Customer Fund to eligible customers commenced on February 23, 2024. As of April 19, 2024, approximately $78.6 million has been distributed to BLMIS account holders with allowed claims in the fifteenth distribution, representing 0.419 percent of the allowed claim amount of each account, unless the claim is fully satisfied.

Fourteenth Pro Rata Interim Distribution (0.265%)

The fourteenth pro rata interim distribution from the Bernard L. Madoff Investment Securities LLC (BLMIS) Customer Fund to eligible customers commenced on February 24, 2023. As of April 19, 2024, approximately $49.7 million has been distributed to BLMIS account holders with allowed claims in the fourteenth distribution, representing 0.265 percent of the allowed claim amount of each account, unless the claim is fully satisfied.

Thirteenth Pro Rata Interim Distribution (0.604%)

The thirteenth pro rata interim distribution from the Bernard L. Madoff Investment Securities LLC (BLMIS) Customer Fund to eligible customers commenced on February 25, 2022. As of April 19, 2024, approximately $113.4 million has been distributed to BLMIS account holders with allowed claims in the thirteenth distribution, representing 0.604 percent of the allowed claim amount of each account, unless the claim is fully satisfied.

Twelfth Pro Rata Interim Distribution (1.240%)

The twelfth pro rata interim distribution from the Bernard L. Madoff Investment Securities LLC (BLMIS) Customer Fund to eligible customers commenced on February 26, 2021. As of April 19, 2024, approximately $233.1 million has been distributed to BLMIS account holders with allowed claims in the twelfth distribution, representing 1.240 percent of the allowed claim amount of each account, unless the claim is fully satisfied.

Eleventh Pro Rata Interim Distribution (1.975%)

The eleventh pro rata interim distribution from the Bernard L. Madoff Investment Securities LLC (BLMIS) Customer Fund to eligible customers commenced on February 28, 2020. As of April 19, 2024, approximately $372 million has been distributed to BLMIS account holders with allowed claims in the eleventh distribution, representing 1.975 percent of the allowed claim amount of each account, unless the claim is fully satisfied.

Tenth Pro Rata Interim Distribution (2.729%)

The tenth pro rata interim distribution from the Bernard L. Madoff Investment Securities LLC (BLMIS) Customer Fund to eligible customers commenced on February 22, 2019. As of April 19, 2024, approximately $515.9 million has been distributed to BLMIS account holders with allowed claims in the tenth distribution, representing 2.729 percent of the allowed claim amount of each account, unless the claim is fully satisfied.

Ninth Pro Rata Interim Distribution (3.806%)

The ninth pro rata interim distribution from the Bernard L. Madoff Investment Securities LLC (BLMIS) Customer Fund to eligible customers commenced on February 22, 2018. As of April 19, 2024, approximately $721.7 million has been distributed to BLMIS account holders with allowed claims in the ninth distribution, representing 3.806 percent of the allowed claim amount of each account, unless the claim is fully satisfied.

Eighth Pro Rata Interim Distribution (1.729%)

The eighth pro rata interim distribution from the Bernard L. Madoff Investment Securities LLC (BLMIS) Customer Fund to eligible customers commenced on February 2, 2017. As of April 19, 2024, approximately $328.8 million has been distributed to BLMIS account holders with allowed claims in the eighth distribution, representing 1.729 percent of the allowed claim amount of each account, unless the claim is fully satisfied.

Seventh Pro Rata Interim Distribution (1.305%)

The seventh pro rata interim distribution from the Bernard L. Madoff Investment Securities LLC (BLMIS) Customer Fund to eligible customers commenced on June 30, 2016. As of April 19, 2024, approximately $248.5 million has been distributed to BLMIS account holders with allowed claims in the seventh distribution, representing approximately 1.305 percent of the allowed claim amount of each account, unless the claim is fully satisfied.

Sixth Pro Rata Interim Distribution (8.262%)

The sixth pro rata interim distribution from the Bernard L. Madoff Investment Securities LLC (BLMIS) Customer Fund to eligible customers commenced on December 4, 2015. As of April 19, 2024, approximately $1.578 billion has been distributed to BLMIS account holders with allowed claims in the sixth distribution, representing approximately 8.262 percent of the allowed claim amount of each account, unless the claim is fully satisfied.

Fifth Pro Rata Interim Distribution (2.743%)

The fifth pro rata interim distribution from the Bernard L. Madoff Investment Securities LLC (BLMIS) Customer Fund to eligible customers commenced on February 6, 2015. As of April 19, 2024, approximately $526 million has been distributed to BLMIS account holders with allowed claims in the fifth distribution, representing approximately 2.743 percent of the allowed claim amount of each individual account, unless the claim is fully satisfied.

Fourth Pro Rata Interim Distribution (3.180%)

The fourth pro rata interim distribution from the Bernard L. Madoff Investment Securities LLC (BLMIS) Customer Fund to eligible customers commenced on May 5, 2014. As of April 19, 2024, approximately $610.4 million has been distributed to BLMIS account holders with allowed claims in the fourth distribution, representing approximately 3.180 percent of the allowed claim amount of each individual account, unless the claim is fully satisfied.

Third Pro Rata Interim Distribution (4.721%)

The third pro rata interim distribution from the Bernard L. Madoff Investment Securities LLC (BLMIS) Customer Fund to eligible customers commenced March 29, 2013. As of April 19, 2024, approximately $907.3 million has been distributed to BLMIS account holders with allowed claims in the third distribution, representing approximately 4.721 percent of the allowed claim amount of each individual account, unless the claim is fully satisfied.

Second Pro Rata Interim Distribution (33.556%)

The second pro rata interim distribution from the Bernard L. Madoff Investment Securities LLC (BLMIS) Customer Fund to eligible BLMIS customers commenced September 19, 2012. As of April 19, 2024, approximately $6.478 billion has been distributed to BLMIS account holders with allowed claims through the first pro rata interim distribution, representing approximately 33.556 percent of the allowed claim amount of each individual account, unless the claim is fully satisfied.

First Pro Rata Interim Distribution (4.602%)

The first pro rata interim distribution from the Bernard L. Madoff Investment Securities LLC (BLMIS) Customer Fund to eligible BLMIS customers commenced October 5, 2011. As of April 19, 2024, approximately $891.1 million has been distributed to BLMIS account holder with allowed claims through the first pro rata interim distribution, representing approximately 4.602 percent of the allowed claim amount of each individual account, unless the claim is fully satisfied.

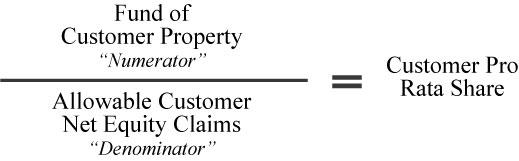

Interim Distribution Calculation

To make interim distributions from the BLMIS Customer Fund, the SIPA Trustee must determine or estimate both the total value of customer property available for distribution (including reserves for disputed recoveries) and the total net equity of all allowed claims (including reserves for disputed claims).

There are unresolved issues that require maintenance of substantial reserves with respect to both the customer property “numerator” and the net equity claims “denominator.” This includes the expected increase of several billion dollars in the value of allowed claims due to the 10 additional claims that have been deemed determined by the SIPA Trustee pending the outcome of litigation, the time value of money and appeals of other settlements.

Nevertheless, even when taking reserves into account, it is possible for the SIPA Trustee, on an interim basis, to determine the (a) allocation of property to the BLMIS Customer Fund or the “numerator”; (b) amount of allowable net equity claims or the “denominator”; and (c) calculation of each allowed claimant’s minimum pro rata share of the Customer Fund.

The equation is as follows:

For the purposes of interim distributions, the SIPA Trustee’s calculations must take into consideration all unresolved issues and establish sufficient reserves to ensure that he would be able to make a pro rata distribution to all potentially eligible claimants, whether or not their claims are allowed at the time of distribution.

There are two primary reasons why significant funds are not available for distribution at this time: required reserves and ongoing appeals.

Required BLMIS Customer Fund Reserves for Deemed Determined Claims

As of April 19, 2024, while there are 2,656 allowed claims and the dollar amount of allowed claims is approximately $19.556 billion, both the number of allowed claims and the dollar amount will increase over time. There remain 10 claims, which have been "deemed determined" by the SIPA Trustee, but their status as "allowed" claims is not yet final, pending the outcome of ongoing litigation. If allowed, these claims would become eligible for all pro rata distributions to date. For this potential scenario, the SIPA Trustee must set aside a reserve for the fifteen interim distributions of 71.136 percent of potential payments and has therefore to date reserved approximately $748.1 million. The ultimate amount of additional allowed claims depends on the outcome of litigation or negotiation and could add billions of dollars to the total amount of allowed claims.

General Reserve

As of April 19, 2024, the general reserve is $0.

Other Customer Fund Required Reserves

As of April 19, 2024, other reserves, including reserve for deferred payments and unallocated funds: approximately $12.5 million.

Amount Unavailable to the BLMIS Customer Fund Due to Required Settlement Reserves

Portions of recoveries related to certain settlement agreements are non-liquid and therefore must be held in reserve. These funds cannot be either allocated to the Customer Fund or distributed to BLMIS customers with allowed claims until these assets are liquidated. As of April 19, 2024, approximately $1.5 million relating to settlement reserves must be held in reserve.

Advances Reimbursed to SIPC on Fully Satisfied Accounts

In the Bernard L. Madoff Investment Securities LLC (BLMIS) liquidation, the Securities Investor Protection Corporation (SIPC) has made cash advances – up to a maximum of $500,000 per allowed claim – available to the court-appointed Securities Investor Protection Act (SIPA) Trustee to distribute to eligible customers, as a way to expedite financial relief to these customers. As of April 19, 2024, SIPC advances for this purpose have reached a total of approximately $850.4 million. The total of SIPC-committed advances will continue to increase as claims that are currently in litigation are allowed as a result of settlements or the conclusion of litigation.

According to the provisions of SIPA, SIPC is reimbursed for its advances to customers once each respective customer claim is fully satisfied. As of the fifteenth pro rata interim distribution in the BLMIS liquidation proceeding, SIPC has received $258.1 million in reimbursement from the Customer Fund for advances paid on fully satisfied accounts.

Reimbursement payments to SIPC are calculated as follows:

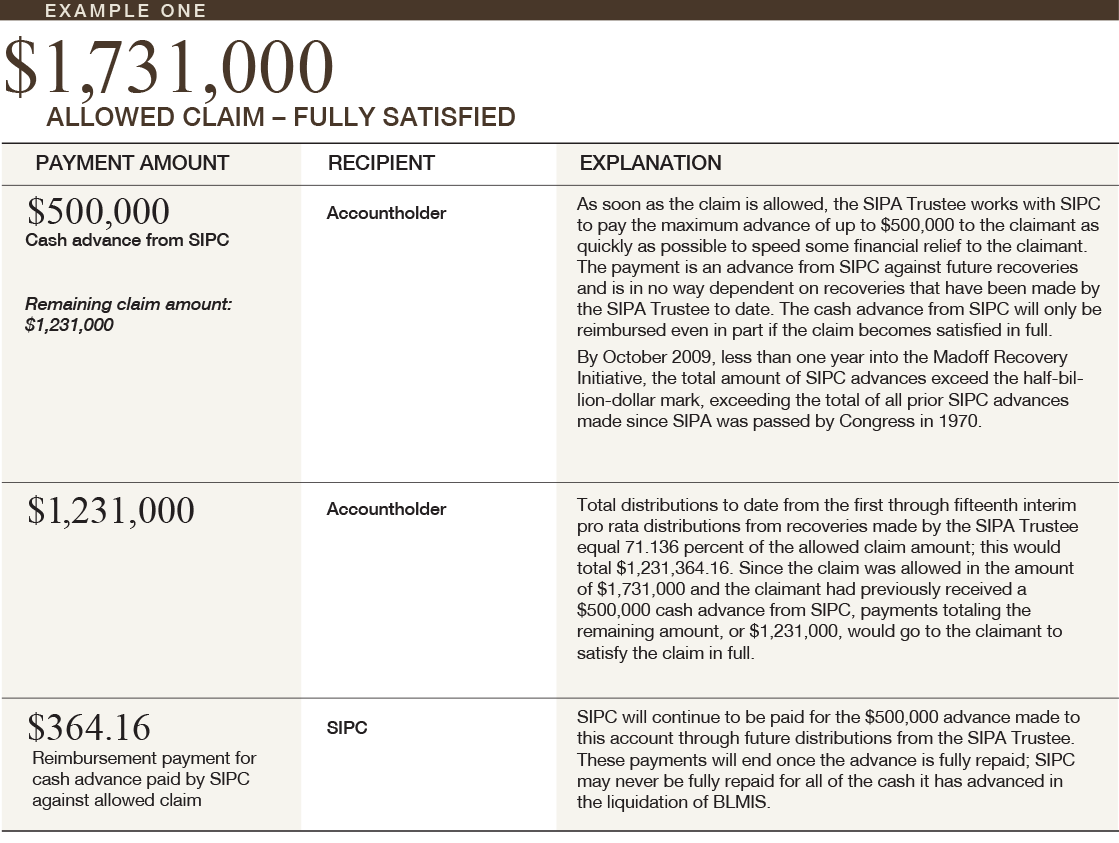

On a claim that has been allowed in the amount of $1,731,000:

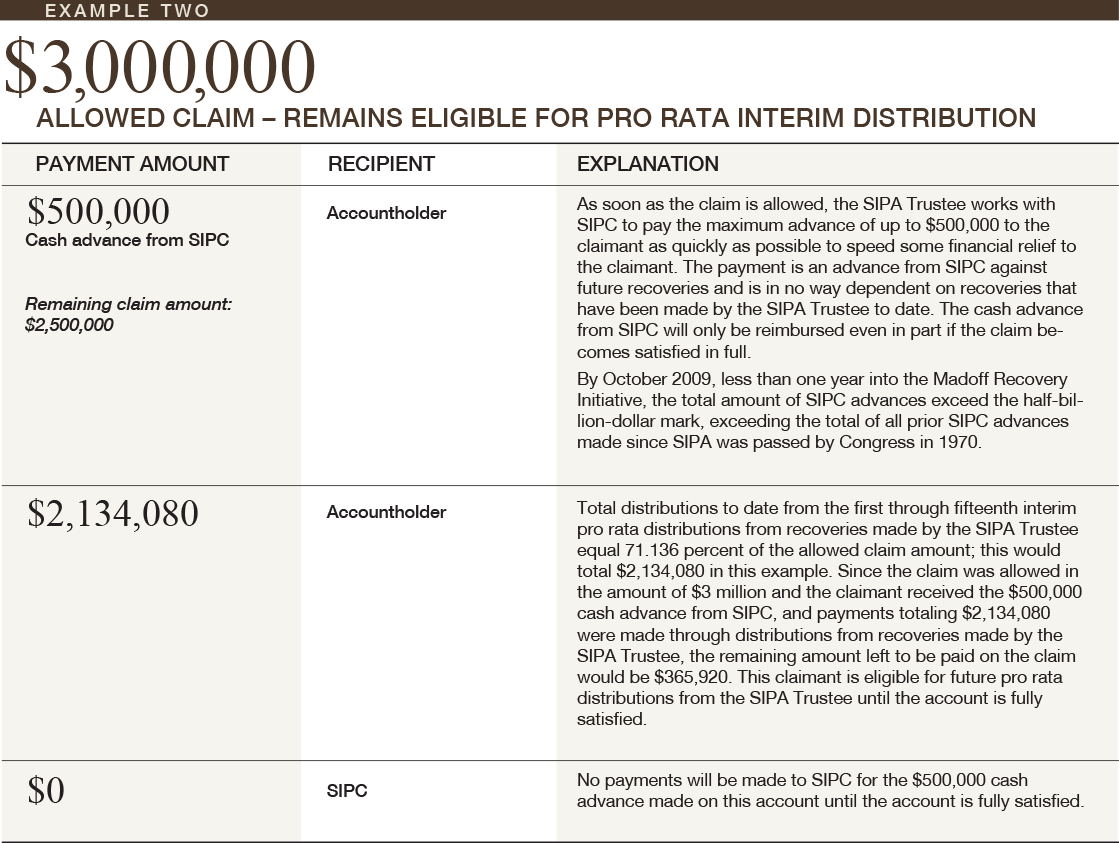

In another example, if a claim were allowed in the amount of $3 million, distributions to date would be as follows: