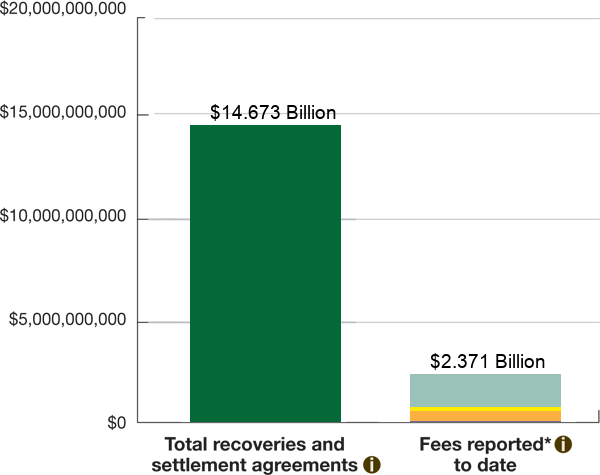

Recoveries & Settlement Agreements Reported as of April 19, 2024:

$13.412 Billion

All amounts approximate

As of April 19, 2024:

Fifteenth Pro Rata Interim Distribution (0.419%)

The fifteenth pro rata interim distribution from the Bernard L. Madoff Investment Securities LLC (BLMIS) Customer Fund to eligible customers commenced on February 23, 2024. Approximately $78.6 million has been distributed to BLMIS account holders with allowed claims in the fifteenth distribution, representing 0.419 percent of the allowed claim amount of each account, unless the claim is fully satisfied.

Fourteenth Pro Rata Interim Distribution (0.265%)

The fourteenth pro rata interim distribution from the Bernard L. Madoff Investment Securities LLC (BLMIS) Customer Fund to eligible customers commenced on February 24, 2023. Approximately $49.7 million has been distributed to BLMIS account holders with allowed claims in the fourteenth distribution, representing 0.265 percent of the allowed claim amount of each account, unless the claim is fully satisfied.

Thirteenth Pro Rata Interim Distribution (0.604%)

The thirteenth pro rata interim distribution from the Bernard L. Madoff Investment Securities LLC (BLMIS) Customer Fund to eligible customers commenced on February 25, 2022. Approximately $113.4 million has been distributed to BLMIS account holders with allowed claims in the thirteenth distribution, representing 0.604 percent of the allowed claim amount of each account, unless the claim is fully satisfied.

Twelfth Pro Rata Interim Distribution (1.240%)

The twelfth pro rata interim distribution from the Bernard L. Madoff Investment Securities LLC (BLMIS) Customer Fund to eligible customers commenced on February 26, 2021. Approximately $233.1 million has been distributed to BLMIS account holders with allowed claims in the twelfth distribution, representing 1.240 percent of the allowed claim amount of each account, unless the claim is fully satisfied.

Eleventh Pro Rata Interim Distribution (1.975%)

The eleventh pro rata interim distribution from the Bernard L. Madoff Investment Securities LLC (BLMIS) Customer Fund to eligible customers commenced on February 28, 2020. Approximately $372 million has been distributed to BLMIS account holders with allowed claims in the eleventh distribution, representing 1.975 percent of the allowed claim amount of each account, unless the claim is fully satisfied.

Tenth Pro Rata Interim Distribution (2.729%)

The tenth pro rata interim distribution from the Bernard L. Madoff Investment Securities LLC (BLMIS) Customer Fund to eligible customers commenced on February 22, 2019. Approximately $515.9 million has been distributed to BLMIS account holders with allowed claims in the tenth distribution, representing 2.729 percent of the allowed claim amount of each account, unless the claim is fully satisfied.

Ninth Pro Rata Interim Distribution (3.806%)

The ninth pro rata interim distribution from the Bernard L. Madoff Investment Securities LLC (BLMIS) Customer Fund to eligible customers commenced on February 22, 2018. Approximately $721.7 million has been distributed to BLMIS account holders with allowed claims in the ninth distribution, representing 3.806 percent of the allowed claim amount of each account, unless the claim is fully satisfied.

Eighth Pro Rata Interim Distribution (1.729%)

The eighth pro rata interim distribution from the Bernard L. Madoff Investment Securities LLC (BLMIS) Customer Fund to eligible customers commenced on February 2, 2017. Approximately $328.8 million has been distributed to BLMIS account holders with allowed claims in the eighth distribution, representing 1.729 percent of the allowed claim amount of each account, unless the claim is fully satisfied.

Seventh Pro Rata Interim Distribution (1.305%)

The seventh pro rata interim distribution from the Bernard L. Madoff Investment Securities LLC (BLMIS) Customer Fund to eligible customers commenced on June 30, 2016. Approximately $248.5 million has been distributed to BLMIS account holders with allowed claims in the seventh distribution, representing approximately 1.305 percent of the allowed claim amount of each account, unless the claim is fully satisfied.

Sixth Pro Rata Distribution (8.262%)

The sixth pro rata interim distribution from the Bernard L. Madoff Investment Securities LLC (BLMIS) Customer Fund to eligible customers commenced on December 4, 2015. Approximately $1.578 billion has been distributed to BLMIS account holders with allowed claims in the sixth distribution, representing approximately 8.262 percent of the allowed claim amount of each account, unless the claim is fully satisfied.

Fifth Pro Rata Interim Distribution (2.743%)

The fifth pro rata interim distribution from the Bernard L. Madoff Investment Securities LLC (BLMIS) Customer Fund to eligible customers commenced on February 6, 2015. Approximately $526 million has been distributed to BLMIS account holders with allowed claims in the fifth distribution, representing approximately 2.743 percent of the allowed claim amount of each individual account, unless the claim is fully satisfied.

Fourth Pro Rata Interim Distribution (3.180%)

The fourth pro rata interim distribution from the Bernard L. Madoff Investment Securities LLC (BLMIS) Customer Fund to eligible customers commenced on May 5, 2014. Approximately $610.4 million has been distributed to BLMIS account holders with allowed claims in the fourth distribution, representing approximately 3.180 percent of the allowed claim amount of each individual account, unless the claim is fully satisfied.

Third Pro Rata Interim Distribution (4.721%)

The third pro rata interim distribution from the Bernard L. Madoff Investment Securities LLC (BLMIS) Customer Fund to eligible customers commenced March 29, 2013. Approximately $907.3 million has been distributed to BLMIS account holders with allowed claims in the third distribution, representing approximately 4.721 percent of the allowed claim amount of each individual account, unless the claim is fully satisfied.

Second Pro Rata Interim Distribution (33.556%)

The second pro rata interim distribution from the Bernard L. Madoff Investment Securities LLC (BLMIS) Customer Fund to eligible BLMIS customers commenced September 19, 2012. Approximately $6.478 billion has been distributed to BLMIS account holders with allowed claims through the second pro rata interim distribution, representing approximately 33.556 percent of the allowed claim amount of each individual account, unless the claim is fully satisfied.

First Pro Rata Interim Distribution (4.602%)

The first pro rata interim distribution from the Bernard L. Madoff Investment Securities LLC (BLMIS) Customer Fund to eligible BLMIS customers commenced October 5, 2011. Approximately $891.1 million has been distributed to BLMIS account holders with allowed claims through the first pro rata interim distribution, representing approximately 4.602 percent of the allowed claim amount of each individual account, unless the claim is fully satisfied.

Amount of SIPC advances reimbursed to SIPC on fully satisfied accounts - $258.1 Million

SIPC is authorized to administer funds to customers of failed brokerage firms as an advance against recovered assets. In this case, SIPC to date has advanced to the court-appointed SIPA Trustee approximately $850.4 million in funds to distribute to BLMIS customers with allowed claims.

According to the provisions of SIPA, SIPC is reimbursed for its advances to customers once each respective customer claim is fully satisfied. SIPC has received $258.1 million in reimbursement from the BLMIS Customer Fund for advances paid on fully satisfied claims, leaving $592.2 million in SIPC advances outstanding.

One hundred percent of the SIPA Trustee's recoveries will be allocated to the BLMIS Customer Fund for distribution to BLMIS customers with allowed claims. The reimbursements to SIPC are for the cash advances to BLMIS customers with allowed claims, which are made when the BLMIS customer claim is first allowed.

Distributions from Customer Fund March 25, 2024

Distributions from Customer Fund March 25, 2024

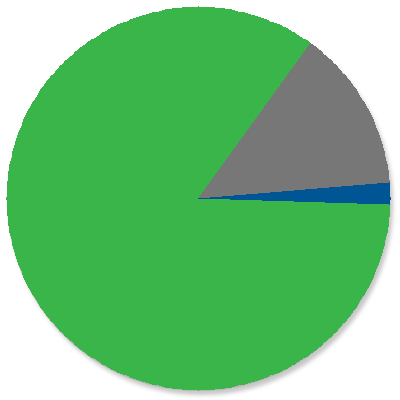

As of April 19, 2024:

In the SIPA liquidation of BLMIS, unresolved matters remain that require court determination. Until resolved, these matters require reserves. These include 10 claims which have been “deemed determined pending litigation” and the SIPA Trustee must establish sufficient reserves to ensure that he would be able to make all pro rata distributions to date to all potentially eligible claimants, whether or not their claims are allowed at the time of distribution.

Required reserve for deemed determined claims: Approximately $748.1 million

General reserve: $0

Other reserves, including reserve for deferred payments and unallocated funds: Approximately $12.5 million

Customer Fund, including required reserves April 19, 2024

Customer Fund, including required reserves April 19, 2024

Portions of recoveries related to certain settlement agreements are non-liquid and therefore must be held in reserve. These funds cannot be either allocated to the Customer Fund or distributed to BLMIS customers with allowed claims until these assets are liquidated. As of April 19, 2024, approximately $1.5 million relating to settlement reserves must be held in reserve.

Amount Unavailable Due to Settlement Reserves April 19, 2024

Amount Unavailable Due to Settlement Reserves April 19, 2024